Nobel Biocare cijfers 1e kwartaal 2011

Exceptionele uitgaven vanwege ramp in Japan

28 april 2011 - Nobel Biocare heeft vandaag de eerste kwartaalcijfers bekend gemaakt. Het hierna volgende bericht werd vrijgegeven:

TTM Service Clubleden klikken hier om een PDF-bestand van de presentatie downloaden.

Revenue growth in Q1; profit affected by exceptional expenses

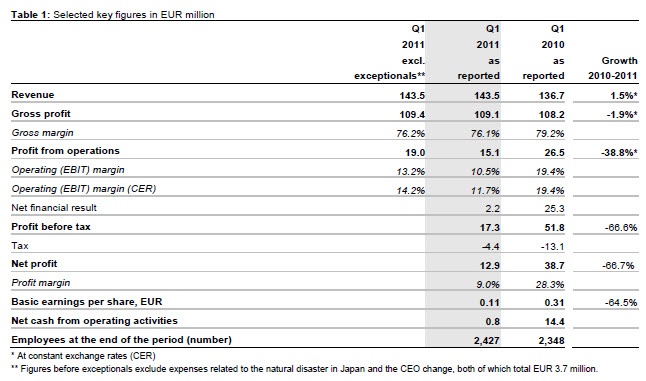

- Reported revenue up 5.0% (up 1.5% at CER) to EUR 143.5 million; impacted by natural disasters in Japan

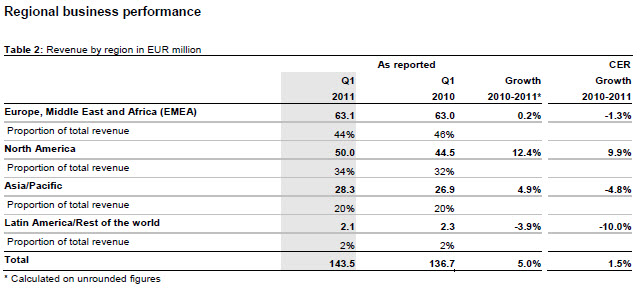

- Growth momentum (CER) led by North America (+9.9%) and APAC excl. Japan (+8.8%); EMEA still negative (-1.3%) but improving

- Gross profit margin at 76.1%; margin mainly affected by NobelProcera capacity build-up

- Underlying operating costs as expected; exceptional expenses related to Japan and CEO change

- Operating profit (EBIT) at EUR 15.1 million; EBIT margin of 11.7% at CER, excl. exceptional expenses 14.2% CER

- Net profit at EUR 12.9 million; net margin of 9.0%

Dirk W. Kirsten, CFO: “We returned to revenue growth in the first quarter 2011 due to operational progress and improving market conditions. Nobel Biocare grew strongly in North America and we improved in EMEA. In APAC, underlying strong growth was materially affected by the natural disasters in Japan. Regarding our innovation, customers are responding well to NobelActive, NobelProcera and the new NobelReplace. Profitability excluding exceptionals is in line with expectations.”

Business update

In Q1 2011, Nobel Biocare continued to focus on operational excellence and investing in its innovative implant systems and NobelProcera CAD/CAM solutions. Customer response to Nobel Biocare’s comprehensive portfolio, as presented at the biennial International Dental Show (IDS) in Cologne, was very positive.

Nobel Biocare announced two next-generation versions of NobelReplace: 1) the NobelReplace Conical Connection (CC) combining the proven tapered NobelReplace implant body with an advanced third-generation internal conical connection and built-in platform shift to increase soft tissue volume, which leads to healthier soft tissue; and 2) the NobelReplace Platform Shift (PS), which offers the ease-of-use of the internal tri-channel connection with the benefits of platform shifting for improved soft tissue interface and more natural-looking esthetics. Both implants, currently in use for clinical trials, are scheduled to be broadly available in Q4 2011.

NobelActive continues to attract an increasing number of dental professionals, with 13 consecutive quarters of double-digit growth. New studies confirm the efficacy of this innovative implant (Cherry et al. and Babbush et al.). To continue to drive growth, the portfolio will be expanded with a new 3.0 mm implant, designed for critical esthetic zones.

NobelProcera offers dental laboratories and dentists the broadest choice of innovative CAD/CAM-based products and solutions from single tooth to fully edentulous indications. The materials comprise high-end, esthetic, all-ceramic alumina, zirconia and IPS e.max CAD, the biocompatible and cost-effective base metal alloy cobalt chromium, and the acrylic material Telio CAD. The range of new materials also includes titanium crowns and bridges, as well as abutments for third-party platforms and implant bar overdenture solutions.

Digitization of the treatmentprocess – At the IDS Nobel Biocare launched upgraded NobelGuide and NobelClinican software. They offer clinicians superior treatment safety and predictability, full flexibility in planning cases, as well as optimized biomechanics, functionality and esthetic outcome thanks to enhanced treatment diagnostics, planning and guided surgery.

Training and Education (T&E) program for dental professionals – In its commitment to advance the dental profession, the company has introduced a new concept for postgraduate dental T&E. It is built around an indication-based curriculum that offers high-level continuing education programs and covers all dental professional needs. The new Nobel Biocare T&E curriculum comprises four key tracks – Prosthetic, Surgical, Planning Software and Guided Surgery & Technical – that describe clear learning pathways.

New long-term data reconfirms efficacy of TiUnite surface – The latest data comes from three 7-8 year long-term follow-up studies of TiUnite on Brånemark implants. The studies included 228 Brånemark implants in 106 patients and revealed a favorable survival rate (CSR) of 97.1% to 100%. The studies were conducted by Turkyilmaz et al. and Glauser and Gelb et al. All studies were accepted for publication in peer-reviewed journals and have been presented at the AO in 2011.

CEO change – As of 1 April 2011, Richard Laube took over the position as CEO. He brings with him considerable international experience in different industries in which innovation was the key to success. Among other things, he converted the OTC business of F. Hoffmann La Roche into a successful, independent unit, and most recently, as CEO of Nestlé’s Nutrition division, more than doubled the business through acquisitions and organic growth.

In Europe, Middle East and Africa (EMEA), revenue (CER) in the first quarter declined by 1.3% to EUR 63.1 million (Q1 2010: -7.1%). While there is still mixed performance across the region, trends of improvement observed in the second half of last year continued also in Q1. Major markets such as Italy, France and Russia grew. Sweden was still slightly affected by the more restrictive reimbursement approach. Germany showed growth for the first time in over four years, following the stabilization of the organization and supported by the biennial IDS in Cologne.

In North America, revenue (CER) in the first quarter was up 9.9% to EUR 50.0 million (Q1 2010: -6.7%). The performance reflects improving organizational capabilities and increasing patient flow to dentists. This was also reflected by the strong interest in the company’s solutions at the AO and CDS conferences. While patient financing generally remains difficult, traffic at the dentist, also for more complex treatments, has been improving since the beginning of 2011. Interest in NobelProcera was confirmed by strong growth, in particular of individualized abutments.

In the Asia/Pacific region, revenue (CER) in the first quarter was down 4.8% to EUR 28.3 million (Q1 2010: -2.5%). The overall performance in this region was significantly influenced by the natural disasters in Japan, a market that accounted for about two-thirds of the regional revenue. Performance in Japan prior to the disasters was stable and reflected further market share gains driven by the recent launch of NobelActive and strong interest in NobelProcera. After the earthquake, production in our undamaged NobelProcera plant in Chiba/Tokyo was temporarily ceased, and orders were shifted mainly to Stockholm. The revenue decline in Japan for the entire first quarter was -12% at CER. Excluding Japan the performance in the region was up 8.8% driven by strong growth in the emerging markets of China and India as well as improving momentum in Taiwan.

Caring for Japan – To help relief and recovery efforts in communities affected by the devastating earthquake and tsunami that struck Japan, Nobel Biocare has launched an immediate financial aid program to support affected customers and their families and businesses in these difficult times.

In Latin America/Rest of the world, first quarter revenue (CER) for 2011 declined by 10.0% to EUR 2.1 million (Q1 2010: -44.1%). This performance is due to a changed distribution model in most markets in late 2009 and through 2010. Profitability in the region has improved significantly and in Brazil, growth was achieved.

Alpha-Bio Tec (ABT) reported double-digit growth in the first quarter 2011, in line with the performance for the full year 2010. The company targets, following a strictly separate approach, different customer groups in markets with a larger price sensitivity.

Financial performance update

Summary – First quarter 2011 revenue, at constant exchange rates (CER), increased by 1.5% to EUR 143.5 million. Reported revenue increased by 5.0% due to favorable foreign currency influences. Growth in dental implants was positive, while NobelProcera performance was mixed: strongly growing demand for the newly introduced products was offset by declining coping volumes. Profit from operations (EBIT) in the first quarter was EUR 15.1 million (2010: EUR 26.5 million) with higher costs due to the natural disasters in Japan and the CEO change, effective 1 April 2011. Excluding those impacts the EBIT margin would have been 13.2% (14.2% CER). Net profit as reported was EUR 12.9 million compared with EUR 38.7 million a year ago, which had benefitted from a one-off currency gain of EUR 30.1 million.

Gross profit in the first quarter was 109.1 million (2010: EUR 108.2 million), reflecting a gross margin of 76.1% (2010: 79.2%). This expected margin decrease mainly resulted from investments in the expansion of manufacturing capacity for NobelProcera as well as the recent temporary manufacturing interruption in Japan and subsequent shift to other plants. The gross margin for implant systems was affected by higher royalties, unfavorable mix and higher precious metal prices.

Operating expenses in the reporting period were EUR 94.0 million (2010: EUR 81.7 million). This increase includes adverse currency impacts of EUR 4.2 million and EUR 3.3 million exceptional costs related to Japan as well as to the CEO change. The remaining increase is as planned and is mainly from increased marketing, event & sales expenses as well as additional R&D costs for NobelProcera and the new NobelReplace.

Profit from operations (EBIT) for the first quarter was EUR 15.1 million (2010: EUR 26.5 million), reflecting an operating margin of 10.5% (2010: 19.4%). This margin mainly results from the aforementioned gross margin decrease as well as increased operating expenses. Adjusted for exceptional expenses related to Japan as well as to the CEO change, EBIT would have been 19.0 million, reflecting a margin of 13.2% (14.2% at CER).

Currencies – The weakening of the euro continued to have a positive influence on reported revenue. However, the stronger Swiss franc and Swedish krona led to a significant increase in reported operating expenses, resulting in a negative impact of 120 bps at EBIT margin level. This negative impact was more than offset by foreign exchange gains, so that the net foreign exchange impact was +240bps.

Net financial result for the first quarter was EUR 2.2 million (2010: EUR 25.3 million). This result was mainly attributable to hedging gains to compensate for the negative impact on EBIT. The variance to 2010 is due to EUR 30.1 million non-recurring foreign currency gains last year, which resulted from changes to internal funding structures. Interest expenses and other finance costs have been reduced compared with the prior year.

Taxes – Tax expenses in the first quarter amounted to EUR 4.4 million versus EUR 13.1 million a year ago. This reflects a base tax rate of 25.5% for the current year.

Net profit for the first quarter was EUR 12.9 million (2010: EUR 38.7 million), reflecting a net profit margin of 9.0% (2010: 28.3%). The decrease mainly results from the lower operating profit as well as the non-repetition of exceptional currency gains, which occurred in Q1 2010.

Cash flow from operating activities for the quarter totaled EUR 0.8 million (2010: EUR 14.4 million), mainly driven by a EUR 15 million one-off tax payments in January 2011 relating to internal business restructuring during 2010. Cash & cash equivalents at the end of March 2011 were at EUR 227.1 million (2010: EUR 257.0 million). Net financial debt amounted to EUR 2.5 million versus a net cash position of EUR 9.1 million a year ago.

Shareholders at the annual general meeting (AGM) held on 30 March 2010 in Zurich, Switzerland, approved all proposals put to a vote by the Board of Directors. Among other agenda items, the AGM approved the allocation of reserves from capital contributions to free reserves to be used for a dividend of CHF 0.35 gross per registered share, a total of EUR 33.0 million, which was paid on 6 April 2011. At the first board meeting following the annual general meeting, Heino von Prondzynski was re-elected Chairman of the Board and Rolf Watter was re-elected Vice Chairman of the Board.

Outlook

In the first quarter 2011 increased market momentum was observed. Based on this, mid-single-digit market growth is expected for 2011. Nobel Biocare continues to focus on innovation and strengthening its organization to exceed customers’ expectations. Barring unforeseen events and excluding the situation in Japan, Nobel Biocare targets to be back to market growth by mid-year. Based on this anticipated revenue growth, the company is targeting an EBIT margin of around 18% for 2011, barring any adverse currency effects and excluding exceptional expenses.

TTM Service Clubleden klikken hier om een PDF-bestand van de presentatie downloaden.

Kunt u niet vinden wat u zoekt? Gebruik de zoekmachine.

december 2025

In dit nummer onder meer aandacht voor een artikel van Tim Janssen: 'De kunst van maatwerk - precisie met impact, Digitale workflows mogen niet leiden tot onpersoonlijke "massa-productie", IPS e.max: Alles wat nodig is voor complexe esthetische rehabilitaties, Ortho-Flex: precisie, familie en vernieuwing in de orthodontische tandtechniek, verslag van de voordracht 'Orthodontie met alveolaire chirurgische ondersteuning' van Coen Oldenburg tijdens de AV van de Branchevereniging Tandtechniek in Slot Loevestein, verslag van DHTA Symposium Bridging the Gap met Herman Willems van Blijdent over digitalisering, 4D-technologie en de virtuele patient en Gert Krijgsman en Karl van Harck van Bredent over Visio.lign in de praktijk, verslag Kroon en Brugwerk onder de Loep 2025, de eerste groepen geslaagden Digital Prosthetic Designer (DPD)-opleiding en de introductie van de een Instapcursus Digitale Prothese met 3Shape op zaterdag 21 maart 2026, Mijnmond.info-Vacature-overzicht, de Dentale Agenda en het Kwaliteitsregister Tandtechniek en meer.

Verspreiding in december 2025.

Heeft u nieuws voor het volgende nummer of een interessante casus? Neem dan contact op met de redactie.